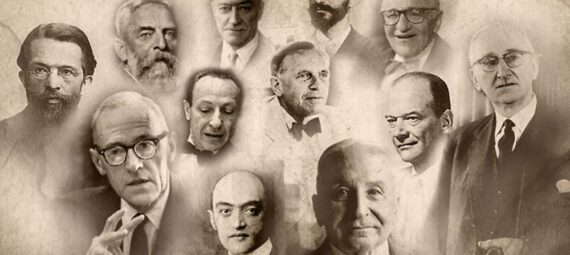

The Austrian School of Economics is well-known for championing free markets and personal freedom. Thinkers like Ludwig von Mises, Friedrich A. Hayek, and Milton Friedman have shared their views on government and taxation, often criticizing taxes that people are forced to pay. From their perspective, mandatory taxation is not just unfair—it’s like theft or even slavery. This article breaks down why they believe that and why free markets offer a better solution.

Why Some Economists See Taxation as Theft and Slavery

Ludwig von Mises was a big critic of government interference in the economy. He argued that when the government forces people to pay taxes, it takes away their hard-earned money and their freedom to choose how to spend it. Mises famously said, “Government is the only institution that can take a useful commodity like paper, slap ink on it, and make it totally worthless.”

In simpler terms, he believed government actions can ruin value and limit our freedom. Taxes, especially those meant to redistribute wealth, force people to give up what they’ve worked for, which goes against the idea of free and voluntary exchange.

Friedrich Hayek, another key thinker, warned that too much government control can quickly lead to the loss of personal freedoms. In his famous book The Road to Serfdom, he said, “Emergencies have always been the pretext on which the safeguards of individual liberty have been eroded.”

Milton Friedman, although not strictly part of the Austrian School but very much in favor of free markets, also criticized how taxes are imposed. He once said, “I am in favor of cutting taxes under any circumstances and for any excuse, for any reason, whenever it’s possible.”

To these economists, taxes aren’t just about money. They see them as a way for governments to control people. When you’re forced to give up your earnings, it’s like being made to work for someone else without your consent—a form of slavery in their view.

How Free Markets Solve the Problem

The Austrian School believes that free markets—where people make choices without government interference—are the best way to run an economy. In free markets, people buy, sell, and trade based on what they want and need. This natural system makes sure resources are used wisely and fairly.

Mises put it this way: “The market is not a place, a thing, or a collective entity. It is a process, actuated by the interplay of the actions of various individuals cooperating under the division of labor.”

In other words, markets are just people making choices and working together. Unlike taxation, which forces people to give up money, market transactions are voluntary—everyone agrees to the trade.

Hayek also warned against governments making too many economic decisions. He said, “The more the state ‘plans’ the more difficult planning becomes for the individual.”

Milton Friedman agreed, stressing that freedom in the economy is essential: “Underlying most arguments against the free market is a lack of belief in freedom itself.”

In free markets, people can donate to charities or causes they care about. This is more efficient and personal than government welfare programs because it cuts out the middleman and lets individuals decide where their money goes.

Why Free-Flowing Economies Work Better Than Planned Ones

The Austrian School’s support for free markets also makes sense when you think about how complex systems work. Economies are like ecosystems—they involve lots of moving parts and people making decisions. In this kind of system, no single person or government can know everything needed to run things smoothly.

Hayek explained this idea by saying, “The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design.”

In a free economy, individuals and businesses make choices based on what they know and need. This creates a system that can adapt and solve problems naturally. In contrast, planned economies, where the government tries to control everything, often waste resources and slow down innovation because planners can never have all the information they need.

Milton Friedman pointed out why free markets handle money better than governments: “Nobody spends somebody else’s money as carefully as he spends his own.”

Free markets allow for quick changes and innovations, making them more flexible and successful than rigid, top-down government plans.

The Moral Side of Taxation

From a moral standpoint, Austrian economists argue that economic decisions should be based on consent and choice. Taxes that are forced on people break this rule. Murray Rothbard, a more extreme voice in this school of thought, summed it up bluntly: “Taxation is theft, purely and simply even though it is theft on a grand and colossal scale which no acknowledged criminals could hope to match.”

The core belief is that any economic exchange should be voluntary. Forcing people to contribute through taxes takes away their freedom, forces them into a state-sponsored morality instead of individual morality and freedom of conscience, and violates their property rights.

At its core, the Austrian School’s argument against taxation is about protecting individual freedom and voluntary exchange. Mises, Hayek, and Friedman all highlighted how forced taxation limits personal freedom and enables government overreach. Comparing taxation to theft or slavery might sound extreme, but it drives home their point about how harmful forced contributions can be.

Instead, they advocate for free markets, where people make choices that benefit everyone. This system is not only more efficient but also respects individual freedom and decision-making. When we think of the economy as a complex system, it becomes clear that free markets naturally adapt and thrive, while government-controlled economies struggle.

In today’s world, as we debate how governments should manage economies and taxes, the Austrian perspective offers a strong case for freedom and voluntary cooperation over coercion and control.